Social Security For Down Syndrome Child

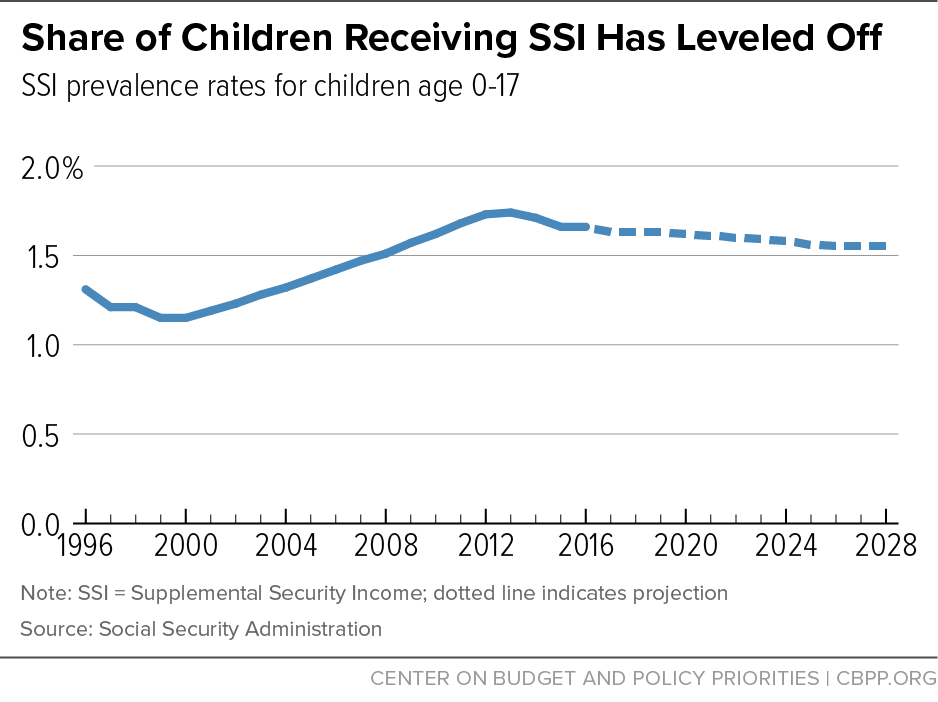

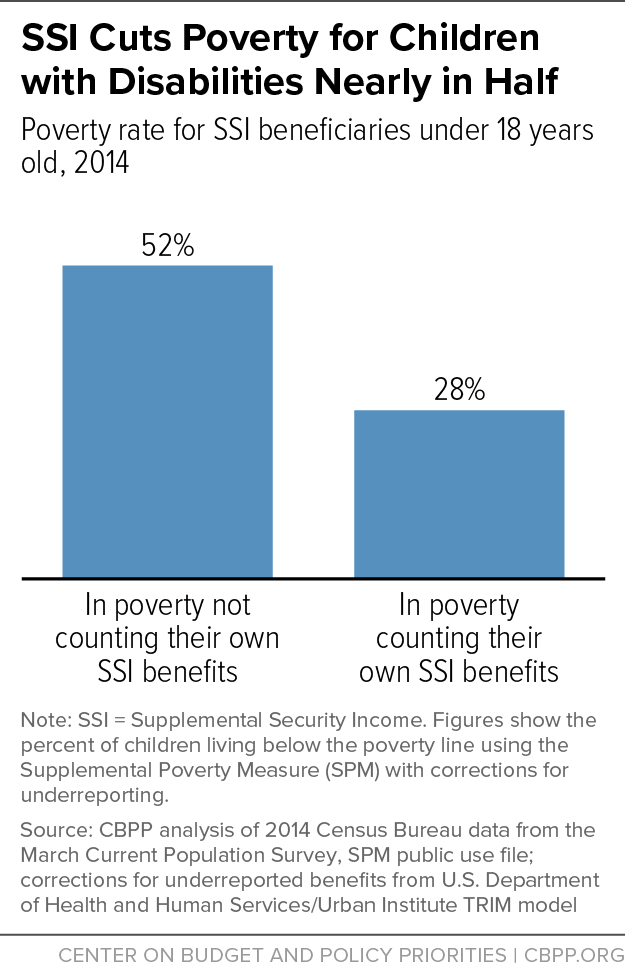

Social security for down syndrome child. Children under age 18 can get SSI if they meet Social Securitys definition of disability for children and there are limited income and resources in the household. Supplemental Security Income SSI and Down Syndrome The Social Security Administration SSA provides Supplemental Security Income SSI to children who are disabled with a severe health condition. Medically Qualifying For SSI Benefits Because Of Down Syndrome.

Down syndrome is covered under the Social Security Administration SSAs Blue Book of impairments under Section 11000. The Social Security Administration SSA offers benefits for people who are unable to work or participate in typical childhood activities due to a serious disability. Individuals who are born with Non-Mosaic Down syndrome are considered disabled from birth by the SSA and will automatically qualify for Social Security Disability benefits.

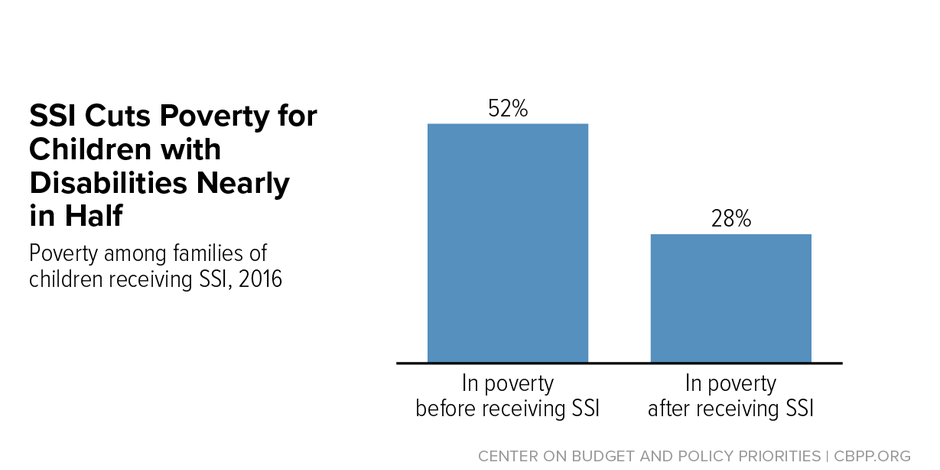

Social Security limits SSI payments to 30 per month when the child is in a medical facility receiving health insurance payments for his or her care. If your child has Down syndrome he or she may be eligible for financial assistance. In many cases children who are diagnosed with Down syndrome automatically qualify for SSI benefits.

The child must have a physical or mental conditions that very seriously limits his or her activities. Gross monthly income limit guidelines range between 3065 and 6009. Disability Evaluation Under Social Security.

The Blue Book is a guide that was created by the Social Security Administration SSA that lists the requirements necessary for particular disabling conditions to qualify for either Supplemental Security Income SSI or Social Security Disability Insurance SSDI. Often a parent will simply need to submit the diagnosis and the childs medical records to the SSA as proof and the child will medically qualify benefits. Non-mosaic Down syndrome chromosome 21 trisomy or chromosome 21 translocation 11008.

Category of Impairments Congenital Disorders That Affect Multiple Body Systems. For a person suffering from this condition to seek SSI he or she must be unable to earn above 1190 per month due to intellectual limitations. The vast majority of people with Down syndrome will automatically medically qualify for disability benefits.

An applicant filing a claim for Trisomy 21 non-mosaic Down syndrome would be. The Social Security Administration offers monthly benefits for people of all ages with disabilities that prevent them from maintaining gainful employment.

Down Syndrome and Social Security Disability Benefits.

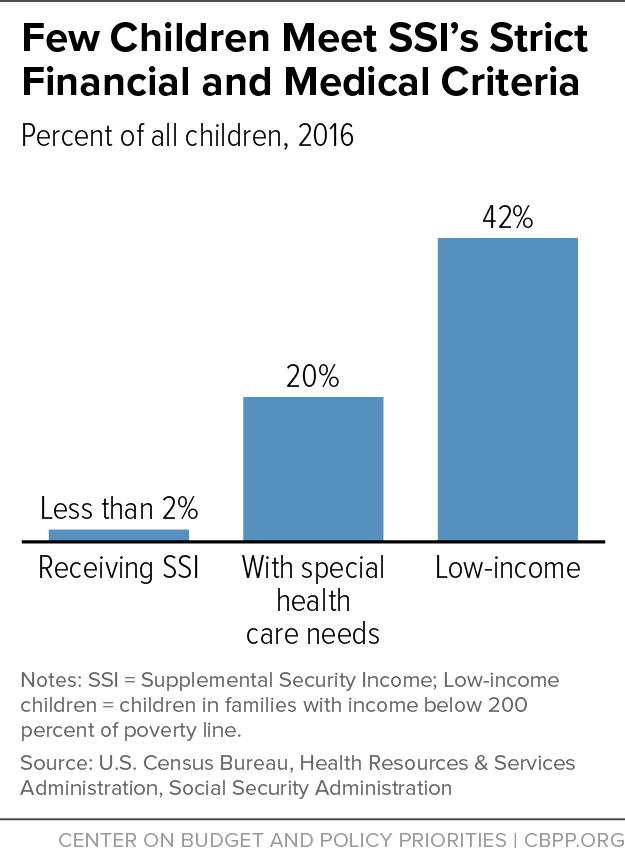

The Blue Book is a guide that was created by the Social Security Administration SSA that lists the requirements necessary for particular disabling conditions to qualify for either Supplemental Security Income SSI or Social Security Disability Insurance SSDI. Children with Down syndrome can seek SSAs Supplementary Security Income also known as SSI benefits. Social Security defines a disability as. In many cases children who are diagnosed with Down syndrome automatically qualify for SSI benefits. Gross monthly income limit guidelines range between 3065 and 6009. Fortunately the Social Security Administration SSA only counts a portion of parents income when determining eligibility for the child. If your child has Down syndrome he or she may be eligible for financial assistance. The Blue Book is a guide that was created by the Social Security Administration SSA that lists the requirements necessary for particular disabling conditions to qualify for either Supplemental Security Income SSI or Social Security Disability Insurance SSDI. The Social Security Administration SSA considers people with Non-Mosaic Down syndrome as being disabled from birth.

The SSA differentiates between Non-Mosaic Down Syndrome and Mosaic Down Syndrome and considers people with non-mosaic Down syndrome as being disabled from birth and automatically eligible for Social Security disability benefits. Social Security defines a disability as. Category of Impairments Congenital Disorders That Affect Multiple Body Systems. Fortunately the Social Security Administration SSA only counts a portion of parents income when determining eligibility for the child. Supplemental Security Income SSI and Down Syndrome The Social Security Administration SSA provides Supplemental Security Income SSI to children who are disabled with a severe health condition. Down Syndrome and Social Security Disability Benefits. Down syndrome is covered under the Social Security Administration SSAs Blue Book of impairments under Section 11000.

/PrematureBaby-fba7a4eaadb5464e844cb709a72e4e22.jpg)

Posting Komentar untuk "Social Security For Down Syndrome Child"