Tenant Improvement Allowance Tax Treatment

Tenant improvement allowance tax treatment. At lease-end tenants can deduct the remaining depreciable balance of these improvements. Improvement allowances may be a fixed amount or based on a certain amount per square foot. TIAs may also be paid directly to vendors on behalf of the lessee.

Current Tax Controversy Whether cash transferred to a retailer as a tenant or construction allowance is includible in. Tenant improvement allowances help cover the cost of construction so it can be extremely frustrating for taxpayers to have to include the improvement allowance in taxable income. As before tenants must depreciate their leasehold improvements over 39 years.

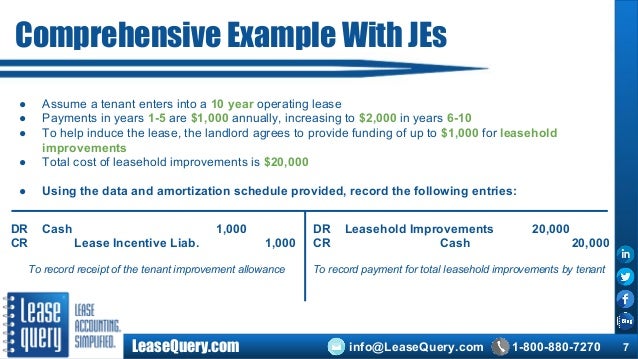

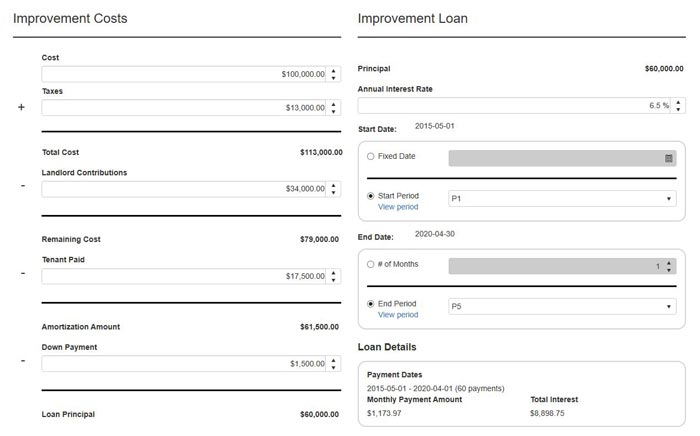

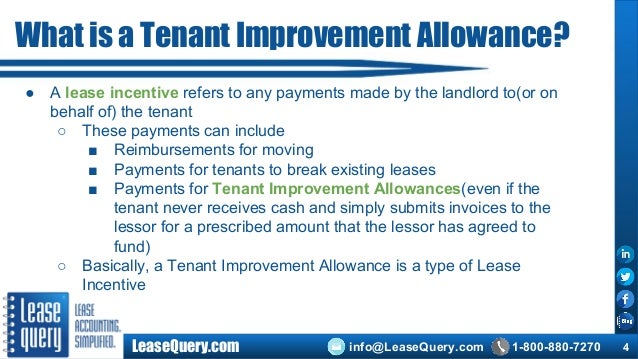

A tenant improvement allowance TIA is generally defined as money paid by a landlord to the tenantlessee to reimburse that tenant for the construction of leasehold improvements such as modifications to commercial real estate. A tenant improvement allowance also known as TI TIA or TA is a pre-negotiated sum of money that a landlord will provide the tenant in order to cover all or a portion of construction costs. When developing language within the lease agreement concerning the tenant allowance.

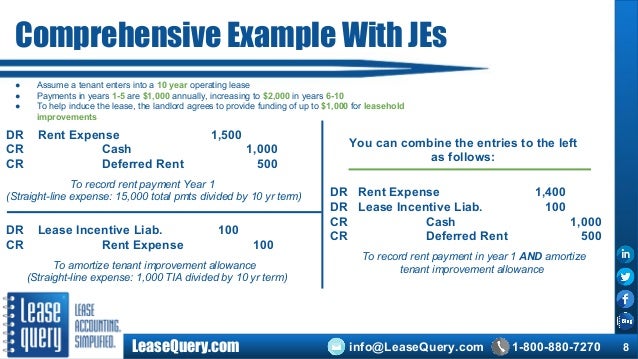

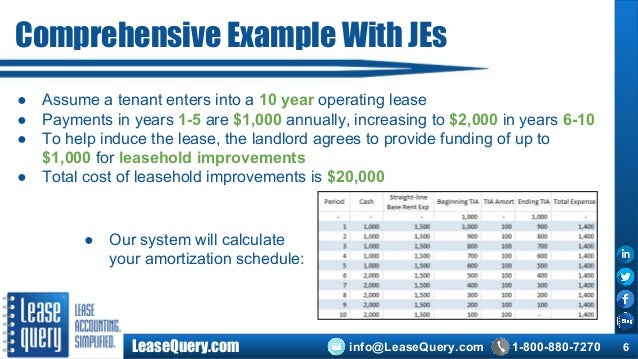

The Tax Treatment of Leasehold Improvements Owned by the Tenant. The leasehold or tenant improvement allowance is recognized straight-line over the period that the right-of-use asset is amortized. The tenant can get next to no tax relief for this expenditure because it is part of the setting.

There would be no tax consequences for the tenant in this scenario unless the tenant also contributes to the cost of improvements. If the landlord incurs the cost directly then costs are capitalized to the building. There is no lessee accounting impact unless the lessee fronts the cost and is reimbursed by the lessor.

New section 168i8 does not affect the treatment of improvements owned by a tenant. The landlord can get no tax relief for the expenditure because he hasnt incuured any costs. In contrast the most important factor in determining the appropriate federal income tax treatment of a tenant improvement allowance generally is the tax ownership of the resulting leasehold improvements determined under a benefits-and-burdens-of.

One way to plan for the tax treatment of tenant allowances is to use the qualified-lessee-construction-allowance safe harbor provided by Sec. If the landlord pays for the improvements he can depreciate the cost of.

The tenant can get next to no tax relief for this expenditure because it is part of the setting.

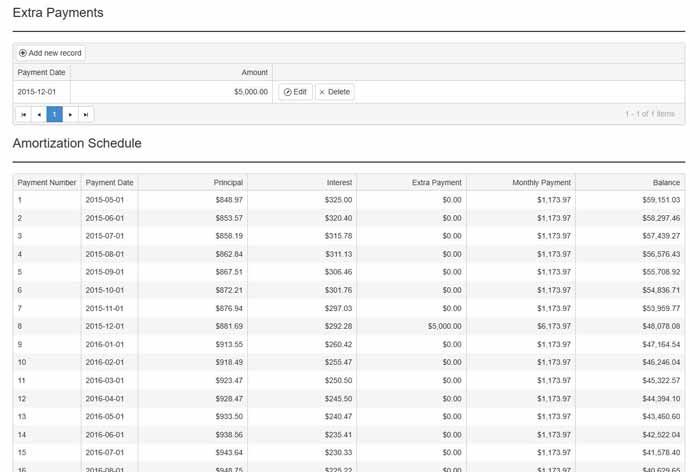

110 could mean immediate taxable income for the tenant and depreciation deductions spread over 39 years. New section 168i8 does not affect the treatment of improvements owned by a tenant. A tenant improvement allowance TIA is generally defined as money paid by a landlord to the tenantlessee to reimburse that tenant for the construction of leasehold improvements such as modifications to commercial real estate. One way to plan for the tax treatment of tenant allowances is to use the qualified-lessee-construction-allowance safe harbor provided by Sec. If the landlord pays for the improvements he can depreciate the cost of. If improvement payments are deemed to be for assets of the lessor then the lessor capitalizes the related cost as a fixed asset. Improvement allowances may be a fixed amount or based on a certain amount per square foot. One of the most highly sought of these incentives is the Tenant Improvement Allowance or sometimes called a Tenant Construction Allowance The tenant improvement allowance is any amount of cash or reduction in rent that a tenant receives from a landlord so that a tenant can renovate the leased space. 110 could mean immediate taxable income for the tenant and depreciation deductions spread over 39 years.

There is no lessee accounting impact unless the lessee fronts the cost and is reimbursed by the lessor. A tenant improvement allowance TIA is generally defined as money paid by a landlord to the tenantlessee to reimburse that tenant for the construction of leasehold improvements such as modifications to commercial real estate. Option 2 Another option would be for the landlord to provide the tenant with an improvement allowance which is an amount the landlord is willing to spend so that the tenant can renovate the space. However proceed with caution. When developing language within the lease agreement concerning the tenant allowance. New section 168i8 does not affect the treatment of improvements owned by a tenant. A tenant improvement allowance also known as TI TIA or TA is a pre-negotiated sum of money that a landlord will provide the tenant in order to cover all or a portion of construction costs.

/remodelling-5bfc2f1ac9e77c00263103eb.jpg)

Posting Komentar untuk "Tenant Improvement Allowance Tax Treatment"